I first heard of trading crack spread when I read a report a few years ago that published a list of the world’s top 30 traders under 30 years old. Many traders were in the field of equities, interest rates or derivatives but one of them caught my attention. His name was Glenn Graham, at age 23, he made his name from trading something called the crack spread and I immediately wanted to learn what it was. Just to mention, at the age of 22, Glenn was already responsible and ran the firm’s entire energy trading operation at Casa Energy.

So, let’s begins with a definition, what is a crack spread? Crack spread is a term used in the oil industry for the differential between the price of crude oil and the petroleum products extracted from it. As many of you are aware, even though oil comes in different density and mix, the term crack spread is used in the world of oil futures trading to describe the potential profit margin that an oil refinery can make by cracking the crude into shorter hydrocarbon chain petroleum products, such as gasoline, kerosene, diesel, jet fuel, etc.

Now, trading the crack spread in the future markets is done with the West Texas Intermediate (WTI) crude on the NYMEX or the Brent Blend crude traded on the London ICE exchanges. Crude oil is graded by their density and these two oil types have an API gravity of around 38-39 degrees, which classify them as intermediate grade, with 0 degrees being the heaviest and 100 degrees the lightest. FYI, the lightest the oil is, the better the quality it is since it's less dense and therefore ready to yield higher value products such as gasoline. Now, for integrated oil companies that controls the entire supply chain from production to distribution of products after refining (ex: XOM, CVX), there is a natural economic hedge in prices with the inputs and outputs. However, for independent oil refiners (ex: VLO, TSO, HOC), they have to consistently hedge their positions with the futures market to protect against price movement of their refined products. That’s why, if you noticed, stock like Valero and Tesoro does not follow oil prices like ExxonMobil does. Don't let this ever fool you to think that a stock is undervalued because all the other oil companies went up and your Valero, the parent company of Ultramar is not moving. Here, I plotted a chart for VLO vs the USO ETF during the oil bubble in 2008, look at the graph and you'll understand what I mean.

So, how does an individual trader go about buying and selling the crack spread? The general crack spread ratios in the market are 3:2:1, 5:3:2 and 2:1:1, with the Gulf Coast 3:2:1 being the most popular, meaning 3 barrels of crude oil = 2 barrels of unleaded gasoline + 1 barrel of distillate fuel oil. On the NYMEX, crack spread futures that are the most traded is the ones with the 3:2:1 ratio. Now let me explain crack spread trading with the simplest terms.

Selling the crack spread: Locking in margin @ 4$

X (crude oil): 6$ Y (gasoline): 5$ Z (fuel oil): 5$

So in the case, if you expect the finished products price to go down relative to the crude oil price going up, you sell the spread to sell the refined products and lock in the profit margin. The other way around, you would buy the crack spread and this is where an investor would enter into a future position to sell short the 3 crude oil futures at a high price while holding a position in the refined gas contracts, than reverse the position with the intension of a positive spread. Obviously, this is the most basic method to explain trading this spread, but to profit from it in reality; it gets much more complicated since there are so many factors that can influence the movement of this spread.

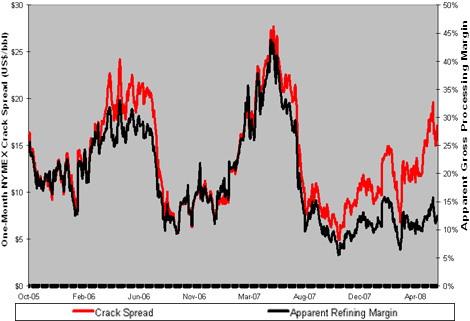

To sum up, here is a graph of the NYMEX crack spread vs. refining margins.

No comments:

Post a Comment