Taken from ZeroHedge.com

First, the irrelevant news:

Today's $29 billion 7 Year auction just closed at a yield of 2.895%, the highest since April 2010, just the time when QE1 was ending and everyone was certain there would be no follow through monetization. The Bid To Cover was 2.79, weaker compared to recent auctions, and 2 bps wider of the When Issued, implying the auction was not all that hot. Directs took down 8.76%, in line with the last year average, Indirects accounts for 49.41%, or the lowest foreign take down since November 2010, while PDs bought 41.83% of the auction. Altogether a weak auction but it's not like the PDs would let it fail especially not with QB9 becoming the next "flip back to the Fed" bond for the PD community.

Next, the relevant news:

Now bear with us for a second: the most recently disclosed total debt was 14,211,567,662,931.23 as of March 28. This excludes the settlement of all of this week's auctions which amount to $35 + $35 + $29 billion (including today) or $99 billion. Adding the two amounts to $14,310,567,662,931.23. As a reminder the debt ceiling is $14,294,000,000,000.00. In other words, the total US debt just passed the debt limit - break out the Champagne! Granted there is a buffer of $52.2 billion between the total debt and the debt actually subject to the ceiling, meaning that America is not in default, yet. Therefore, the total debt subject to the limit assuming full settlement right now is $14,258,341,662,931. Which means the US is now $35.7 billion away from a bona fide breach of the debt ceiling. Yes, there are some caveats, and it is possible that there will be an accelerated redemption of bills over the next few days, pushing the total debt slightly lower, but readers get the idea. Complicating things, the SFP unwind is complete with just $5 billion in 56 Day Cash Management Bills on the books, and no longer a buffer of debt ceiling extension.

Which brings up the question: with a government shut down looming any minute, shouldn't Congress be tackling the issue of what happens when the US enter technical default some time in the second week of April when the next battery of approximately $67 billion in new bonds are issued, which also happens to be just as tax rebate (and thus outflow) season peaks?

This blog is your one stop shop to get updated articles and my papers on topics related to Economics, Politics, Fixed Income, Credit Derivatives and Financial Engineering. Here, you can also download my quarterly market reports and have access to all the live market and world news all in one page. Be sure to bookmark and to follow the RSS feed!

Gods of the World

Thursday, March 31, 2011

Monday, March 14, 2011

The Fed and it's SOMA

It’s been a while since I last wrote an article about the central banks so since I am currently half way though an 800 pages book about the history of the Fed titled The Secret of the Temple; I am going to explain in this short article what are the problems facing the Fed’s SOMA, which stands for the System Open Market Account. This account is where the central bank holds the MBS, treasuries and agency securities which currently stands at approximately 2.25$ trillion, up 62% from the previous year due to the recent QE2 purchases. So, why is the size of this account so important for the economy?

Well first, for Bernanke, other than the inflation risk that such massive liquidity might spark, the interest rate risk of the holdings in the account is another one of his main concerns. As we hear about the increasing inflation expectation in the United States, the yields along the curve is climbing back up from its historical low so therefore the market value of this portfolio will decrease accordingly to the yield changes. These MBS carries the highest interest rate risk because of their lack of liquidity comparing to the other agency securities and if you remember from your CFA studies, these MBS also carries an additional problem called the prepayment risk. Not only is the structure of these securities a problem, but as prepayment slows down when interest rate rises, this will create larger losses to these MBS products that represents a 40% of the entire account. According to the Fed, their current holding of MBS in the SOMA is about 965$ billion with a duration of 7 years.

Well now, what is the second problem? When the Fed gets closer to the end of the QE2 purchases to expand their balance sheet and the SOMA portfolio, this is basically the end of the easy money game for the commercial banks as the Fed will discontinue the purchase of their assets. The large amount of cash which are held at the banks will begin to move around in search of higher yields, so with an imposed reserve requirement of 10% and the 1.04$ trillion of excess reserves that is currently stored at the central bank, the additional loans that will flood into the market will add fuel to the problem of inflation.

Last and not least, as I wrote about how Obama is getting near his debt limit and while the budget deficit is on pace to hit 1.48$ trillion for 2011, the private market will have to start absorbing the treasuries as the Fed is still currently the main buyer for over 90% of the daily issuance at about 5.5$ billion a day. As the Fed backs out from the huge daily funding, will the private market be able to pick up such a huge purchase on its own? I can already feel it coming, they are going to need the Chinese again but hey, then they are going to blame them for fixing their currency from buying their securites, just like how Donald Trump is publicly blaming the Chinese for the US

Wednesday, March 09, 2011

Pimco's Biggest Fund Dumps Treasury Bond Holdings

Well how about that? After my many publications and articles talking about how expensive the US treasurys are getting and how Obama is lucky to have the Chinese government lending them money to spend at such a low rate, my man Bill Gross finally pulled a trigger on his total return fund...Its about time..Here is the whole news article:

Pimco's Total Return Fund, the world's biggest bond fund, has dumped allU.S.

Pimco's Total Return Fund, the world's biggest bond fund, has dumped all

The move was not a surprise given Pimco chief Bill Gross's recent statements that Treasurys are over-valued.

"It just gives people that follow him the bias not to bullish on the Treasury market," said Jefferies Treasury Strategist John Spinello. "He thinks rates are going higher." In fact, there was little reaction in the bond market when news of move leaked out Wednesday morning.

In January, Pacific Investment Management's $236.9 billion Total Return fund slashed its U.S.

Government-related securities include Treasurys, Treasury Inflation-Protected Securities, agencies, interest rate swaps, Treasury futures and options, and corporate securities guaranteed by the U.S. Federal Deposit Insurance Corp.

The Total Return Fund's cash holdings had surged to $54.5 billion as of Feb. 28 from $11.9 billion at the end of January.

Bill Gross, the fund's manager who helps oversee more than $1.1 trillion as Pimco's co-chief investment officer, has often railed against U.S.

In December, Pimco said it may start investing up to 10 percent of its assets in "equity-related" securities, such as convertibles and preferred stock, after the first quarter of 2011.

"It's certainly an important signal in the sense that they are allocating away fromTreasurys in favor of a higher spread product," said Christian Cooper, head of U.S. dollar derivatives trading at Jefferies.

Thursday, March 03, 2011

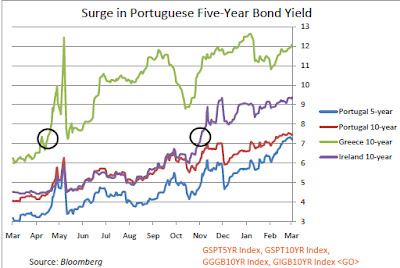

Portugal Five-Year Yields Point to Possible Bailout

From Bloomberg Economic Report:

The surge in Portuguese five-year note yields to record levels is adding to pressure on euro-area policy makers to resolve the region’s sovereign-debt crisis. The yield on the securities has climbed 38 basis points to 7.22 percent since Feb. 11, and is now just 25 basis points less than that of 10-year debt. The increase for shorter-dated debt reflects increasing bailout risks in Portugal following the financial rescues of Greece and Ireland, said Mohit Kumar, a fixed-income strategist at Deutsche Bank. "Both the level and the shape of the curve express a clear no-confidence vote," said Michael Leister, a fixed-income analyst at WestLB. "Everyone is waiting for policy makers and hoping for a solution." EU leaders have given themselves until a March 24-25 summit to craft a package to revive investor confidence. Merkel said yesterday EU leaders will make a statement of "clear political commitment" when they meet on March 11. Portugal will accept a financial bailout "within the next few weeks" as costs to issue debt become unsustainable, said Christopher Iggo, chief investment officer for fixed income at Axa Investment Managers. "The borrowing costs are just too high" for Portugal, Iggo said. "Ireland and Greece had to go for a bailout once their borrowing costs got that high, so Ifully expect Portugal to go within the next few weeks." — Paul Dobson

The surge in Portuguese five-year note yields to record levels is adding to pressure on euro-area policy makers to resolve the region’s sovereign-debt crisis. The yield on the securities has climbed 38 basis points to 7.22 percent since Feb. 11, and is now just 25 basis points less than that of 10-year debt. The increase for shorter-dated debt reflects increasing bailout risks in Portugal following the financial rescues of Greece and Ireland, said Mohit Kumar, a fixed-income strategist at Deutsche Bank. "Both the level and the shape of the curve express a clear no-confidence vote," said Michael Leister, a fixed-income analyst at WestLB. "Everyone is waiting for policy makers and hoping for a solution." EU leaders have given themselves until a March 24-25 summit to craft a package to revive investor confidence. Merkel said yesterday EU leaders will make a statement of "clear political commitment" when they meet on March 11. Portugal will accept a financial bailout "within the next few weeks" as costs to issue debt become unsustainable, said Christopher Iggo, chief investment officer for fixed income at Axa Investment Managers. "The borrowing costs are just too high" for Portugal, Iggo said. "Ireland and Greece had to go for a bailout once their borrowing costs got that high, so Ifully expect Portugal to go within the next few weeks." — Paul Dobson

Subscribe to:

Posts (Atom)